Must Read

It sounds unbelievable, but it really happened. A graduate of the University of Lagos, who finished in the 2024/2025 academic session, has revealed how he was able to pay his school fees without using his salary, allowance or hustle money. According to him, his school fees paid itself, with profit, because he applied wisdom in financial management and invested his money instead of rushing to make payments immediately. Read Our Last Post: How a Young Graduate Shocked Everyone by Delaying NYSC, Building Her Own Business, and Entering Service as a Successful Entrepreneur

He narrated that he entered UNILAG in the 2018/2019 session and finally graduated in 2025, after spending seven years studying a five-year course because of the interruptions caused by the Academic Staff Union of Universities strike and the COVID-19 pandemic. Despite the long years, what stood out for him was the financial lesson he learnt.

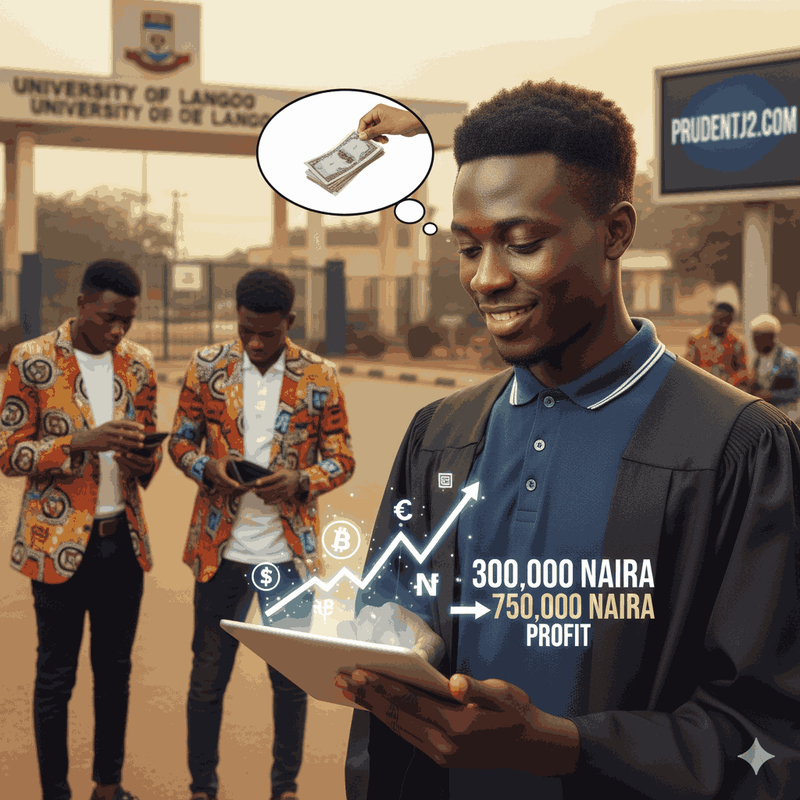

When UNILAG suddenly increased the school fees from about one hundred and twenty thousand naira to nearly three hundred thousand naira, many students and parents cried out in frustration. Students were shouting, parents were lamenting, and lecturers were defending the school management. But instead of panicking, this student decided to take a different approach.

He explained that when the school portal opened for payment, he took the three hundred thousand naira and divided it into four different investments. One hundred thousand naira went into a Money Market Fund. Another one hundred thousand went into carefully selected penny stocks in the Nigerian Stock Market. Fifty thousand naira went into cryptocurrency, specifically Bitcoin. The last fifty thousand went into an equity mutual fund called InvestNaija by Chapel Hill Denham.

He closed his eyes and left the money there. While others rushed to pay immediately, he ignored the constant reminders from the school management and waited. By the time he was ready for his project defence and needed to pay, he liquidated his investments.

To his surprise, that same three hundred thousand naira had grown into seven hundred and fifty thousand naira. He withdrew the money, paid his three hundred thousand naira school fees, and still had four hundred and fifty thousand naira left as profit.

On that same day, one of his classmates came to him crying that he had not been able to pay school fees. The classmate had only one hundred thousand naira and needed an additional two hundred thousand naira to be allowed to defend his project. From his profit, he gave him the two hundred thousand naira and saved his academic career.

During their final examinations, others came to him needing different amounts, some fifty thousand, some thirty thousand, some ten thousand. He supported them as well, but he did not feel the impact because he was giving out of his capital gain, not from his main school fees money.

He compared this principle to what even a common market woman understands. Mama Ngozi in Mile 12 market knows that if she sells a bag of pepper today for fifty thousand naira and reinvests her profit, she can feed her children with the gains and still keep her business alive. The problem, according to him, is not that people do not have money, but that they do not manage their money properly.

He went further to reveal that while some of his classmates were busy spending money on Ankara Day, Jersey Day and Colour Splash Day, snapping pictures in customised uniforms, others could not even pay their school fees to be allowed to sit for examinations. In fact, one of the very students he supported was busy wearing Ankara to school events, while he, the one who gave out money, could not afford to buy one for himself. On their final day, while many classmates wore expensive customised jackets, he wore a plain polo shirt worth four thousand naira which a friend helped him to buy.

But he was not sad, because he knew the difference between showing off wealth and building real wealth. According to him, some students had the full three hundred thousand naira but rushed to pay their fees immediately, and in the end gained nothing. He delayed, invested, and multiplied his money.

He concluded that many Nigerians are also making this same mistake today. People buy expensive iPhones but cannot buy shares or stocks. They pay for cable television subscriptions but cannot invest in mutual funds. They spend on pepper soup every weekend but do not have fifty thousand naira saved for emergencies. Then they turn around and complain that Nigeria is hard.

The truth, he emphasised, is that Nigerians do not lack money. They lack money management. He advised that the secret is to invest before spending, to delay gratification, to help people from profit and not from capital, and above all, to understand that financial literacy is freedom.

He noted that even as an accounting student, he once offered free financial literacy classes to his classmates but most of them rejected the offer, saying there was no time. Later, the same people came begging him for school fees. For him, knowledge was what separated those who remained broke from those who became financially free.

-Picsart-AiImageEnhancer.jpeg.png)