Must Read

A Nigerian borrower has raised alarm over what he described as unfair charges by a popular loan platform, Easemoni, after his repayment plan turned into a heavy burden despite paying a large part of the money. Read Our Last Post: Gunmen Attack Young Man at Kenneth Junction, Enugu, Steal Belongings and Leave Him Injured

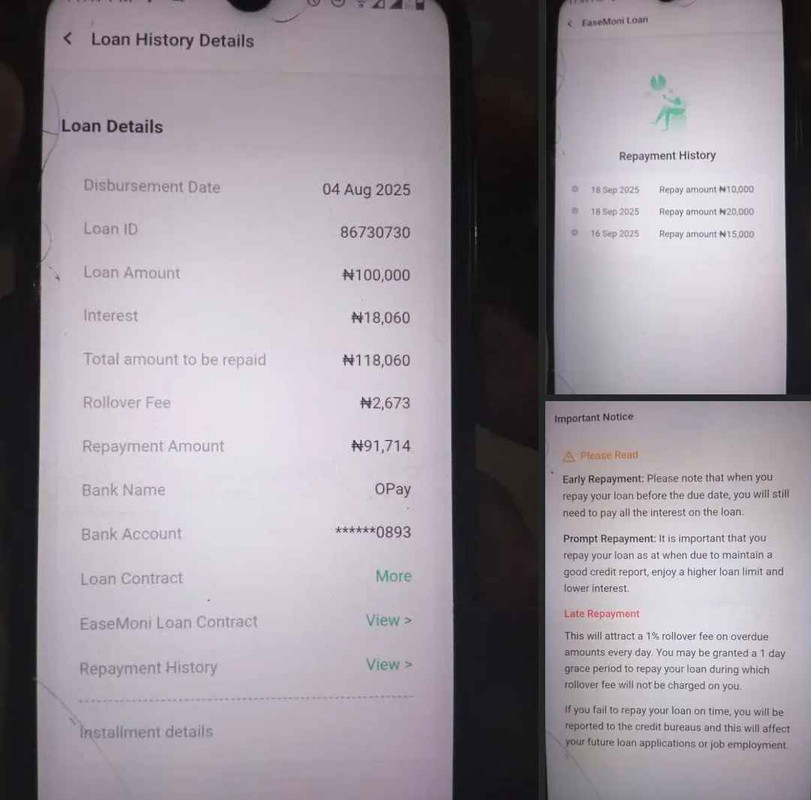

The man, who took a loan of N100,000, said he was meant to pay back N118,000 at the agreed date. However, he mistakenly missed the repayment deadline. His original plan was to clear the loan on the due date and then take another loan to support his business.

Because the loan was already overdue, he feared that even if he paid everything back, the company would not allow him to take another loan. He decided to pay gradually to reduce the outstanding balance.

According to him, he first paid N45,000 last week, leaving about N80,000. At the time the loan stood at N118,000, Easemoni was charging him a rollover fee of N1,000. But after he made the N45,000 payment, the rollover fee suddenly increased to N2,600.

He explained that he had planned to pay another N20,000 this week to bring down the debt to about N60,000, with the hope of finishing repayment before the end of the month. However, he was shocked to discover that the more he paid, the higher the rollover fee became.

Frustrated, he said he has now decided to stop any further repayment, regretting the N45,000 he had already paid.

In his words:

“I am so pained right now. I cannot understand how one percent of N90,000 is more than N2,500. This is not fair at all. I feel like I have been trapped.”

The borrower is now asking how he can report Easemoni to the relevant authorities to seek redress.

This complaint adds to growing concerns over the practices of online loan companies in Nigeria. Many users have in the past accused some of these platforms of using hidden charges, harsh repayment conditions, and intimidation to exploit borrowers.

Consumer protection experts have often advised Nigerians to carefully read loan terms and conditions before accepting them. They also encourage borrowers facing unfair treatment to report to the Federal Competition and Consumer Protection Commission (FCCPC), which is the main agency responsible for regulating financial consumer issues.

The FCCPC had in recent years sanctioned and shut down some digital loan companies for exploitative practices. However, many still operate in ways that put borrowers under intense pressure.

For this borrower, his greatest pain is not only the growing debt but also the N45,000 he had already paid. He believes that unless something is done, many Nigerians like him will continue to fall victim to questionable lending practices.

-Picsart-AiImageEnhancer.jpeg.png)