Opay SafeBox

Opay SafeBox

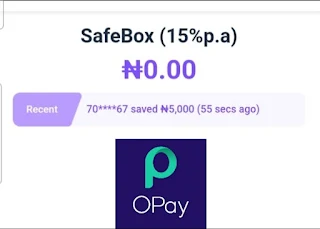

Opay SafeBox is a digital financial service offered by OPay, a mobile payment platform based in Nigeria. SafeBox is a feature that allows users to save and earn interest on their savings through the Opay app.

With SafeBox, users can save any amount of money for a specified period of time and earn interest on their savings. The interest rate is fixed and is based on the duration of the savings plan. The longer the savings period, the higher the interest rate.

Opay SafeBox offers users a secure and convenient way to save money without the hassle of physical banking. Users can access their funds at any time, but there is a penalty for early withdrawals.

To use Opay SafeBox, users must first have an OPay account, which can be created through the mobile app. Once logged in, users can navigate to the SafeBox section and choose the duration of their savings plan. They can then transfer funds from their OPay wallet to their SafeBox account.

Overall, Opay SafeBox is a useful tool for people looking to save money and earn interest on their savings. However, as with any financial service, users should carefully read the terms and conditions before signing up to understand the fees, penalties, and other details.

Save towards acquiring a home or paying your rent.

Deposit anytime

Save daily, weekly or monthly and enjoyup to four free withdrawal days yearly

High returns

Earn 15% annual interest. Interest isaccumulated daily and paid to youmonthly

Secure & guaranteed

Your funds are protected with the same256-bit HTTPS SSL as all other banks,and deposits are insured by the NDIC.

What is SafeBox?

A SafeBox is a savings product developed by BlueRidgeMicrofinance Bank and available on the OPay App. Itenables you to save at any time, set automatic depositsand enjoy four free withdrawal days yearly.

What is the annual interest rate of SafeBox?

With SafeBox, you can earn up to 15% annual interest onsavings. For balances of N300,000 and below, your dailyinterest will be calculated at 15% annual interest rate whilefor balances over N300,000, the first N300,000 will becalculated at 15% interest rate while the remaining balancewill be calculated at 6% annual interest rate.

In compliance with Nigerian Tax regulations, a WithholdingTax of 10% applies to the interest earned on your savings

Here is an example:

If your total SafeBox balance is N400,000, N300,000 will becalculated at 15% annual interest rate while the N100,000balance will be calculated at 6% annual interest rate.Therefore, your annual profit earned will be (300,000 * 15%+ 100,000 * 6%) * (1-10% withholding tax) = 45,900

How is SafeBox interest calculated?

A Interest on SafeBox is calculated daily and paid on the firstday of the next month.

Daily interest = Amount * ((1 + Annual Interest Rate) ^(1/365)-1) * (1-10% withholding tax)

How do I make a deposit into SafeBox?

There are two ways to deposit:

1. By clicking the "Quick Deposit' button, you can depositamount between N1 to N100,000,000. You can add moneywith your OPay balance, OWealth balance, Bank account orBank cards.

2. You can set up "AutoSave Deposit" and save withdiscipline on a monthly, weekly or daily basis. Once set, the money will be automatically transferred from your OPaybalance to your SafeBox savings.

What are Withdrawal Days?

There are 4 withdrawal days in a year (March 31st, June30th, September 30th & December 31st). It's free towithdraw on withdrawal days. This is to promote savingsdiscipline and help you meet your savings goals faster.You can also set your own withdrawal days however, onceset, you cannot go back to using SafeBox's WithdrawalsDays.

What is a Breaking Fee?

A Breaking fee is a charge deducted for requesting awithdrawal on non-withdrawal days. Breaking fees are2.5% of the withdrawal amount, min N0.01.

How long do I have to wait to receive my moneyafter withdrawing from my SafeBox balance?

Withdrawals are processed within 48 hours.

Can I cancel my SafeBox plan and request for awithdrawal at any time?

Yes. Funds in your SafeBox can be withdrawn anytime(Even on non-withdrawal days but this attracts a 2.5%breaking fee of the withdrawal amount)

-Picsart-AiImageEnhancer.jpeg.png)